Ace Info About How To Find Out If You Have Bad Checks

Keep a copy for your.

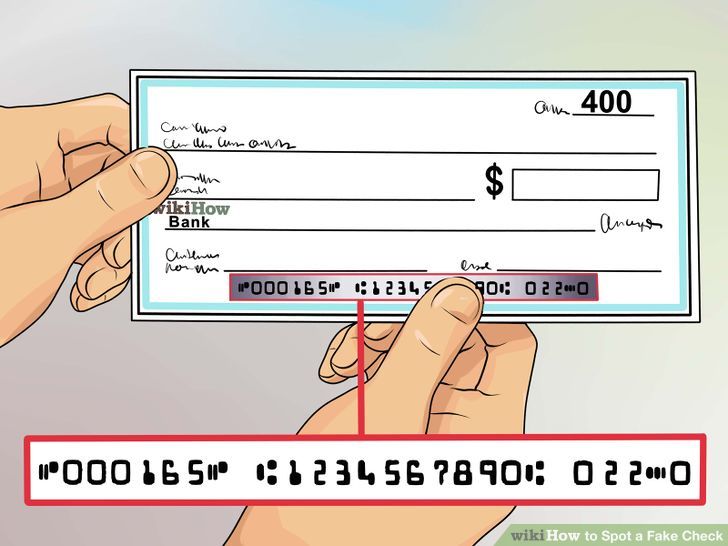

How to find out if you have bad checks. Chexsystems is used by merchants and financial. Note that the update might not be immediately available for all. A check drawn on a nonexistent account or on an account with insufficient funds to honor the check when presented.

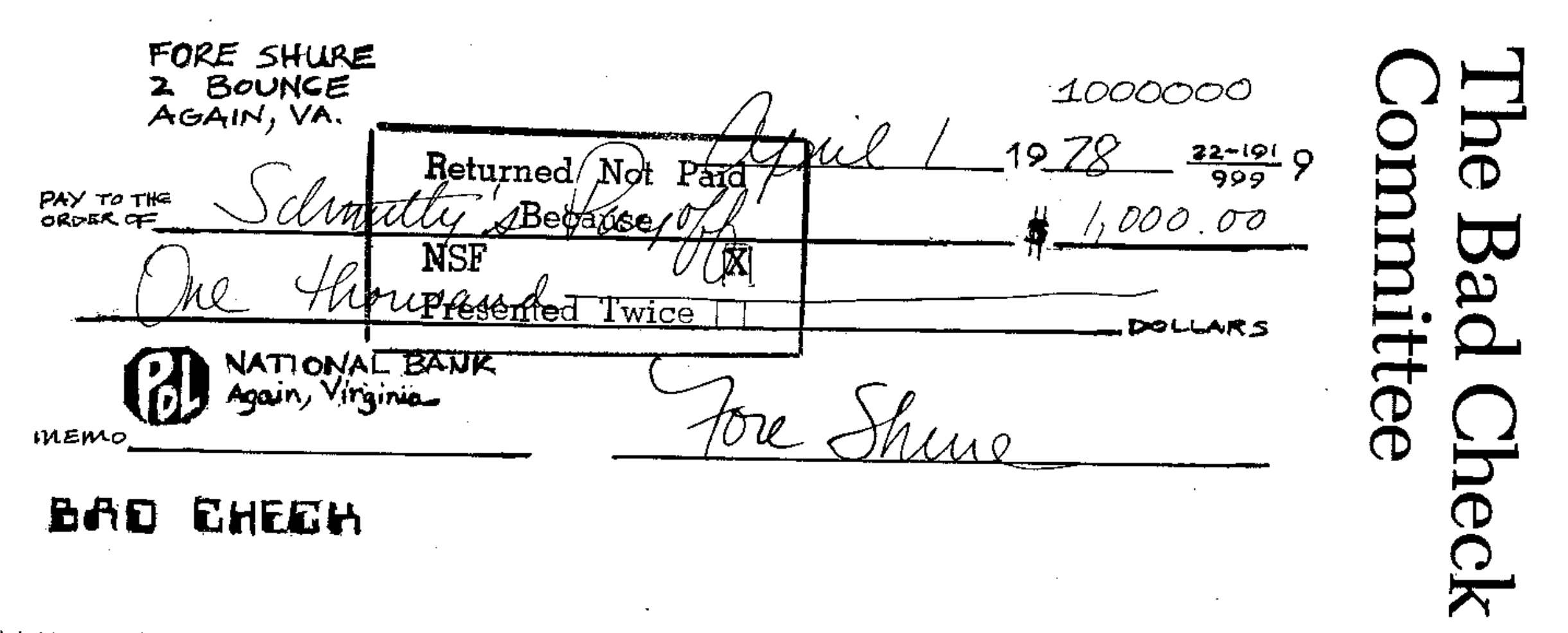

A bad check is a check that a bank refuses to honor. If the update is available, click on the download button. Click on the check for updates button.

Up to 15% cash back hi loridae, the best way to get the information you are looking for is to contact chexsystems. Send a certified letter (and request a return receipt) asking for verification. Banks and credit unions provide information.

Fake checks and your bank. If you don’t mind getting cash for the check rather than depositing it directly to your bank account, visit the bank that issued the check and try to cash. [1] further, georgia law provides penalties that may be imposed on any person who writes a check knowing that it will not be honored by the bank or credit union.

How to avoid writing bad checks. By law, banks have to make deposited funds available quickly, usually within two days. Cash the check in person.

There are multiple reasons why a bank may take this course of action. Passing bad checks is illegal, and the. If you've bounced checks in the past or you owe money to a bank, there's a good chance that you're in the chexsystems database.