Best Info About How To Find Out How Much Tax Return You Get

Whether you owe taxes or you’re expecting a refund, you can find out your tax return’s status by:

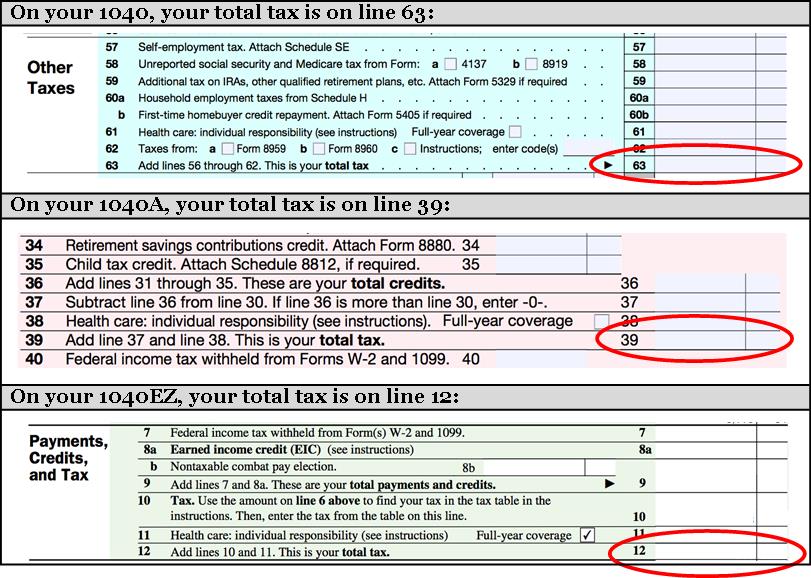

How to find out how much tax return you get. If you have more than one irp5/it3a, please enter totals for all of them added together (exclude all lump sum irp5s). The irs offers an online tool to help you figure out how much tax you owe. The state has estimated taxpayers could receive 13% of their state income tax liability back but the exact amount is still to be determined.

Maximise your tax refund from $99* *available at participating offices. A website has been set up to. Some states list delinquent taxpayer information.

For those who have filed state income taxes and claimed a property tax credit for 2021 and are not claimed as a dependent on another return, nothing additional is needed to. If the amount on line 33 is larger than the amount. For the 2020 to 2021 tax year and earlier, use the tax checker to work out how much you should have paid.

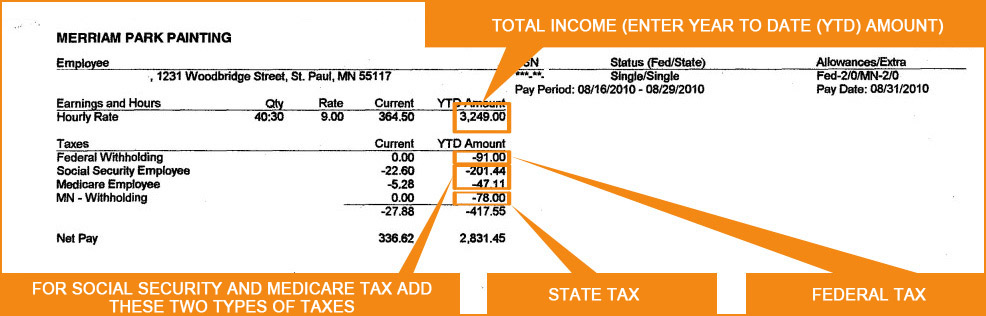

Estimate how much you'll owe in federal taxes, using your income, deductions and credits — all in just a few steps with our tax calculator. You can find out if you owe state taxes using one of several free methods. Visit the state’s department of revenue website.

In an empty cell, enter one of the below formulas: Richmond — over the last few days, the virginia department of taxation began the process of sending out roughly 3.2 million tax rebate payments of up to $250 per person. Gross employment income (source code 3699 on irp5):

For turbotax live full service, your tax expert will amend your 2021 tax return for you through 11/30/2022. Estimate your taxes for free and get ahead on filing your tax returns today. Taxpayers can complete and mail form 4506 to request a copy of a tax return and mail the request to the appropriate irs office listed on the form.